Tax Rates

QUICKLINKS

| Real Estate | $0.65 per $100 |

| Personal Property | $2.79 per $100 |

| Machinery & Tools | $1.25 per $100 |

| VA Sales Tax | 5.3.% |

| Groceries | 5% (non-food) | 2.5% (food) |

| Lodging | 7% |

| Food & Beverage | 4% |

| Business License | $30 annual flat rate |

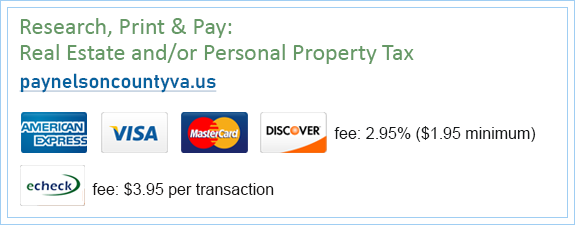

Online Tax Payments: Option 2

| You may pay your personal property taxes and real estate taxes online www.officialpayments.com There is a convenience fee – based on the amount paid. |

Dates to Remember

Real Estate & Personal Property Taxes (2x/year)

| Bills mailed May 1 – Taxes due June 5 |

| Bills mailed October 1 – Taxes due December 5 |

State Income Tax Forms are Due May 1

| Estimated State Returns Due: |

| January 15 | April 15 | June 15 | September 15 |

Meals & Lodging Taxes

| File by the 20th day of the month following the calendar month for which tax is due |

Dog Tags

| Available on November 1. Payment required by January 31 |

COMMISSIONER OF REVENUE

84 Courthouse Square

P.O. Box 246

Lovingston, VA 22949

Kim Goff, Commissioner of Revenue

434-263-7070

Linda Grubb | Danielle Saunders | Haley Campbell

Deputy Commissioners of Revenue

434-263-7070

fax: 434-263-7074